AstraZeneca Buys T Cell Engager for $100 Million

AstraZeneca has paid $100 million upfront to acquire TeneoTwo, a small biotech and its T cell engager as part of a $1.67 billion deal. The decision comes after one of TeneoTwo’s lead drug candidates enters the clinic for multiple types of lymphoma.

TNB-486 is a Phase I clinical-stage D19/CD3 T-cell engager, which is currently under evaluation in relapsed and refractory B-cell non-Hodgkin lymphoma. Nearly 30 patients have been enrolled in the trial so far.

- T Cell Engagement and Redirection: Strategies, Methods, and T Cell Design

- Harnessing Bispecific T Cell Engagers and T Cell Primers in Cancer Treatment

- Broadening Horizons for Bispecific Effector Cell Redirection

AstraZeneca’s acquisition of TNB-486 aims to accelerate the development of new therapeutic opportunities for B-cell haematologic malignancies, including diffuse large B-cell lymphoma and follicular lymphoma. The official press release shared on Tuesday stated: “Building on the success of Calquence (acalabrutinib), TNB-486 further diversifies AstraZeneca’s haematology pipeline that spans multiple therapeutic modalities and mechanisms to address a broad spectrum of blood cancers”.

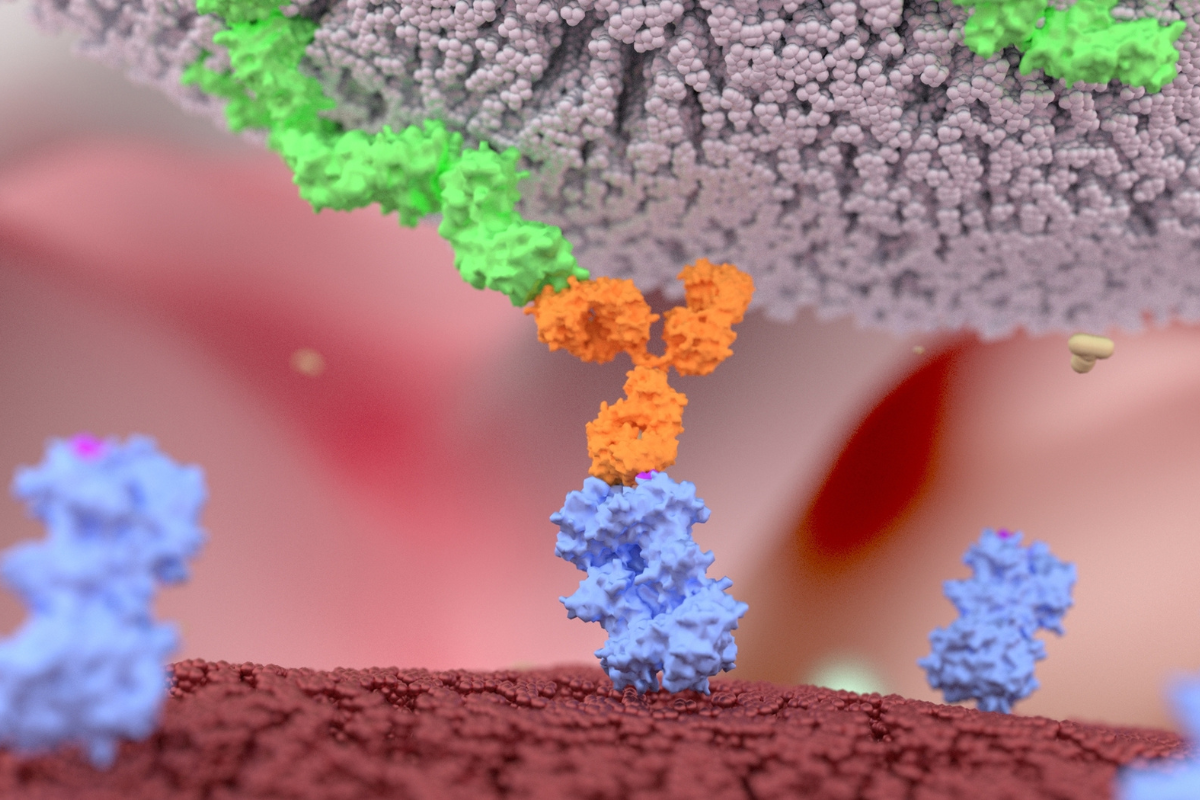

Anas Younes, Senior Vice President Haematology R&D, at AstraZeneca, commented: “By redirecting the body’s natural immune response to target B-cell malignancies, TNB-486 alone or in combination with CD20-targeted therapy could potentially deepen clinical responses and improve patient outcomes.

AstraZeneca’s acquisition of TNB-486 aims to accelerate the development of new therapeutic opportunities for B-cell haematologic malignancies.

We believe this innovative molecule, which was designed to optimise the therapeutic window of T-cell activation, will enable us to explore novel combinations that have the potential to become new standards of care in this setting.”

Under the terms of the agreement, AstraZeneca acquires all outstanding equity of TeneoTwo. The deal will also see AstraZeneca make additional contingent R&D-related milestone payments.

The transaction is expected to close in the third quarter of 2022, subject to customary closing conditions and regulatory clearances.

Join Oxford Global‘s 2023 Biologics UK: In-Person event today. This 3-day conference brings together a panel of prominent leaders and scientists, sharing new case studies, innovative data and industry outlook.

Keep up to date with the latest Industry Spotlight offerings at the Biologics Content Portal.